India ranks second globally in the number of international students, reflecting the strong academic drive among Indian students and the allure of quality education abroad for advancing career prospects. Many Indian graduates of prestigious international institutions have gone on to lead major global companies. Studying abroad not only broadens horizons but also opens up promising career opportunities. Beyond academics, students explore new cultures and surroundings, enriching their educational experience.

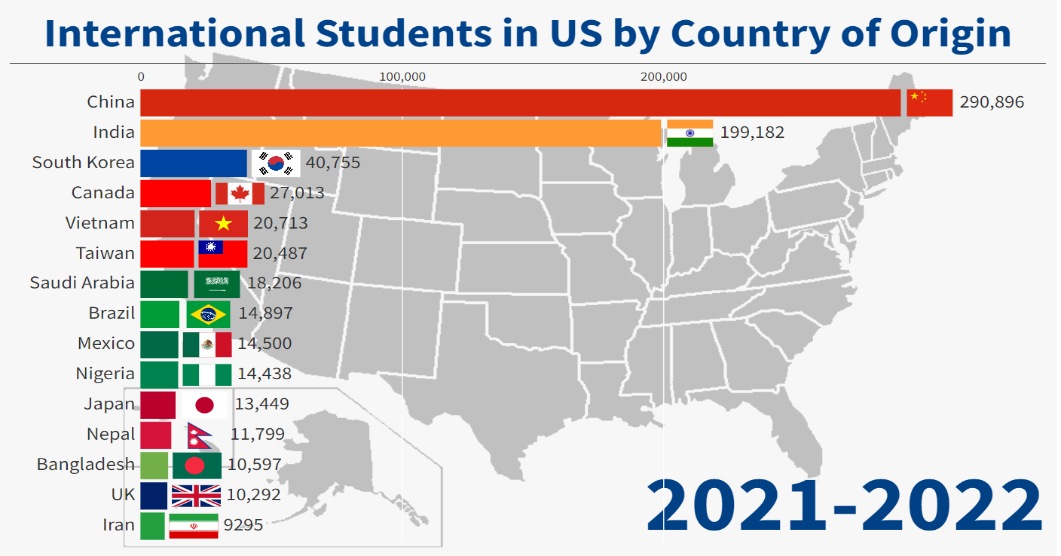

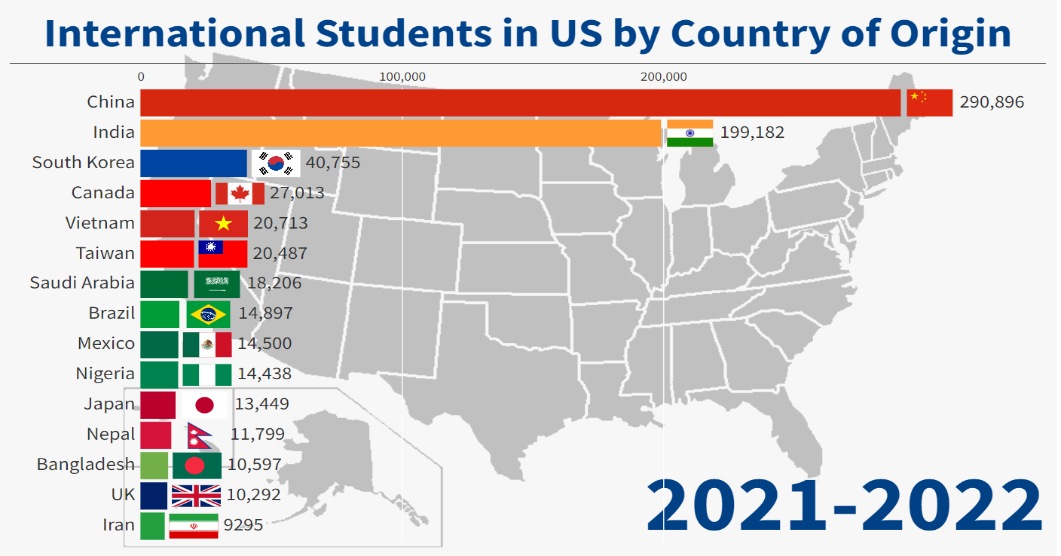

As of recent data from the Ministry of External Affairs, Government of India, approximately 550,000 Indian students are studying in 86 countries worldwide, across various universities and academic years. . Around 50% of these students choose North America, particularly the United States, for higher education, with annual growth rates averaging 7-8%. The distribution among countries varies widely, with some hosting fewer than 100 students while others, like the USA and China, hosting tens of thousands.

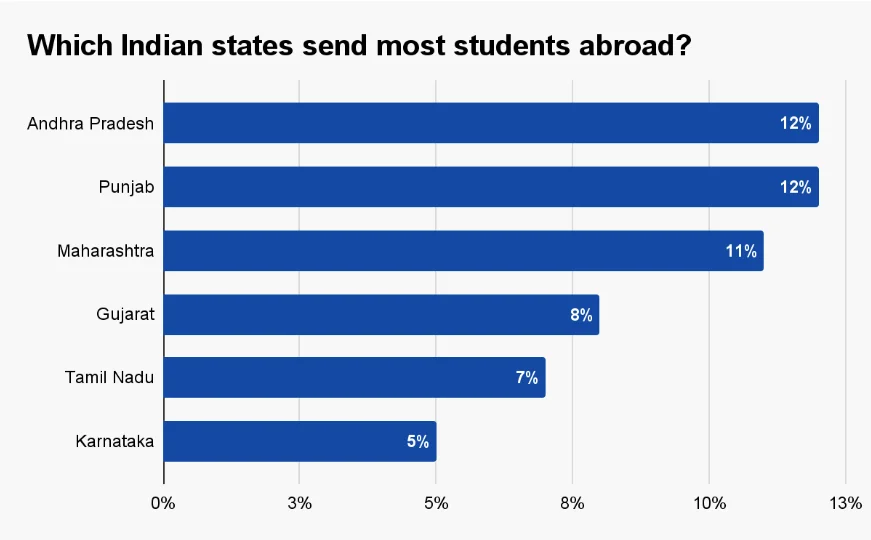

| Open doors report data | 2021/22 | 2022/23 | %increase |

|---|---|---|---|

| Indian international students in United States | 199,182 | 268,923 | 35% |

| Undergraduate students | 27,545 | 31,954 | 16% |

| Graduate students | 102,024 | 165,936 | 62.6% |

| OPT | 68,188 | 69,062 | 1.3% |

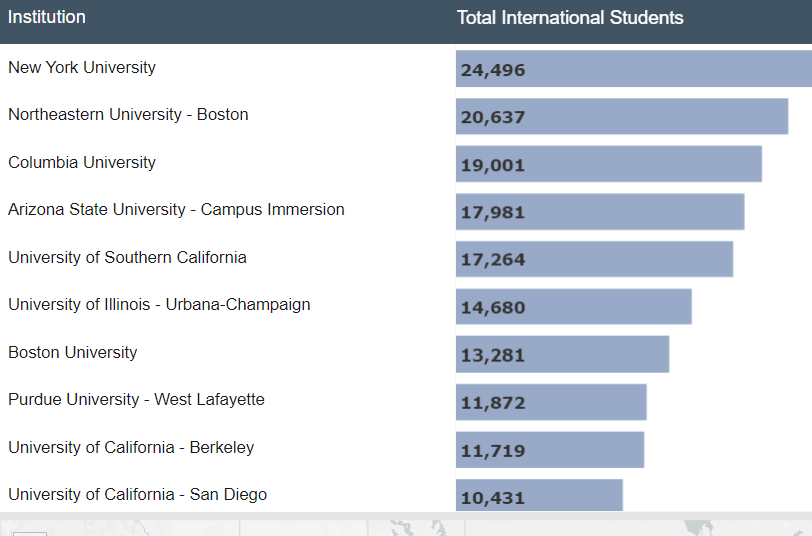

Notably, the majority of students originate from a handful of cities and states, with Andhra Pradesh and Telangana accounting for a significant portion.

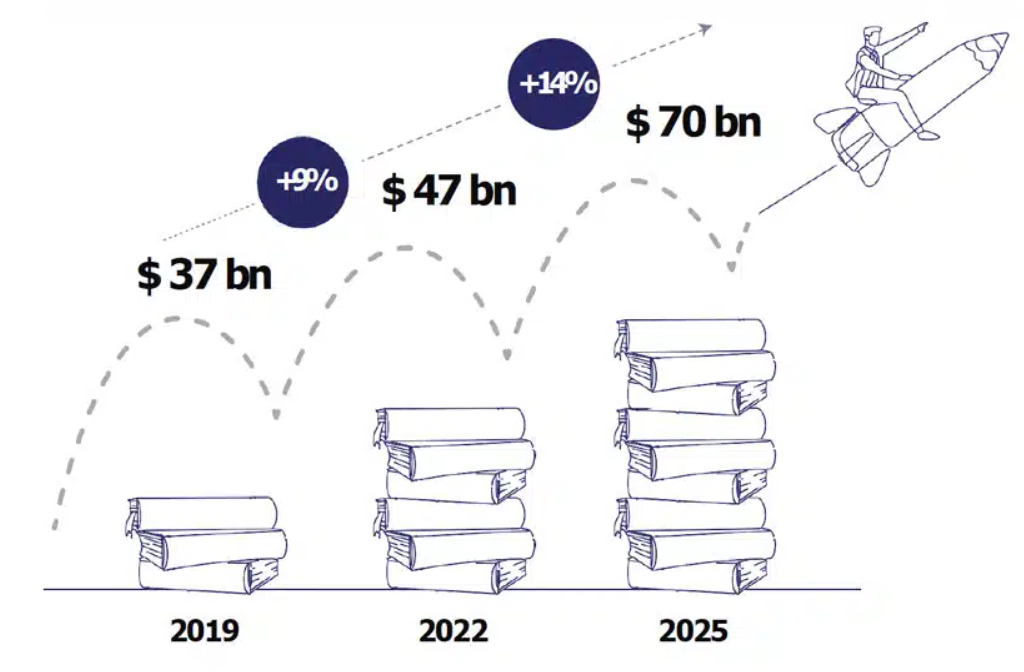

While studying abroad is a substantial financial commitment for most families, the expenditure continues to rise annually, and is expected to touch an unprecedented $70 billion by 2025. This covers tuition, accommodation, and other incidental expenses abroad. Despite the costs, the USA remains a primary destination, with nearly 200,000 Indian students studying there annually, second only to China.

Medical emergencies or unexpected incidents can occur during students overseas stays, underscoring the importance of comprehensive student medical insurance.

Although many universities offer local insurance plans, Indian insurers provide comparable coverage at more affordable premiums, payable in Indian Rupees but covering expenses in US Dollars.

Such insurance not only covers medical expenses but also includes provisions such as bail bonds for situations like arrest or detention abroad due to bailable offenses.

In conclusion, while pursuing education abroad offers immense opportunities, it's crucial for students to safeguard themselves with reliable insurance coverage. This ensures that they can focus on their studies and personal growth without the worry of unforeseen financial or medical crises.

There are many insurance companies in the market that offer different types of policies. It is advisable that students compare student travel insurance coverage details before buying. Choose best Indian student insurance plan that suits your specific student insurance requirements and purchase using a credit, a debit card or a cheque. A brief comparison table of the coverages offered by the India insurance plan on eIndia website is tabled below. Please note that this is not the entire list of coverages, but a comparison of the coverages relevant to the Student’s trip abroad for studies.

There are almost 200,000 Indian students travelling abroad every year on student visas to pursue their higher studies at Universities/Colleges abroad. Almost 50% of these students are bound to USA, while there are many also going to European and UK Universities/Colleges, as well as Australia. Indian insurance companies today offer specific Student Health insurance plans with comprehensive coverages for the India student. It is important to note that most Indian Student Health insurance plans meet the local health insurance requirements required by the University/College.

The Student Health insurance plans cover the mandatory Accident & Sickness (A&S) cover offering options upto $500,000. Apart from the A&S cover, the plans also offer student specific benefits like Sponsor Protection, Study Interruption, Compassionate Visit, Maternity Coverage, Mental Illness & Nervous Disorder cover etc. The premiums are also very competitive when compared to what is offered by the University/College. India Insurance companies like Tata AIG, Bajaj Allianz, HDFC Ergo, Religare Health, Reliance General, Apollo Munich, Royal Sundaram etc offer comprehensive Student Health Insurance options.

These are some of the well known insurance companies who offer affordable student medical insurance policies. Click on ‘buy’ button to access free quotes offered by these insurance companies.

Student Insurance policies from India insurers are very competitively priced when compared to the insurance plans offered to the student by the College/University. (For example for a 25 year old student going to USA for higher studies for a period of 1 year (365 days), the insurance premium across multiple products from Indian insurance companies ranges from ₹ 26,000 to ₹ 44,000 for the whole trip – this is for a coverage of USD $500,000 which is around ₹ 3.40 cr for Accident & Sickness. If we take the average cost of 1 years fee to be around ₹8,00,000, then the insurance premium contribution is just 3.2%. These premiums will be even lower when the student is visiting any other country in Europe, UK, Australia, Asia etc.). It is important to note that apart from Accident & Sickness the plans also have many relevant benefits for students like Compassionate Visit, Sponsor Protection, Study Interruption, Cancer Screening & Mammography, Maternity Coverage etc. Students should ideally compare the Indian Insurance plans vis-à-vis what the College/University is offering before making a decision. Indian Insurance plans also offer cashless treatment if the student is seeking inpatient treatment for an accident or sickness. If the student is indeed travelling with an Indian Student insurance plan, and the College/University needs an Insurance waiver form to be submitted, the same can be provided by the India insurer. Hence it is strongly recommended that every student buys a student insurance policy before leaving India.

Do international students need health insurance?Yes, student health insurance is necessary for all students planning on pursuing their studies abroad. This is mandatory irrespective of which College/University the student is joining anywhere in the world. Apart from the fact that student health insurance is mandatory, it is advisable for the student to protect themselves financially from any unexpected exigencies (both medical and non medical) that can occur while they are abroad. Under the Medical cover, the student is protected against Accident & Sickness expenses, Personal Accident, Medical Evacuation and Repatriation while Non Medical coverages include Maternity Coverage, Study Interruption, Compassionate Visit, Sponsor Protection, Cancer Screening & Mammography etc. Since the students are anyways spending a reasonably high sum of their parent’s money (either savings or through educational loans), it is prudent to spend 3-4% more and protect themselves against any untoward incident. Being insured also allows the student to remain stress free and focus on their studies.

What is international student health insurance?International Student Health insurance is a comprehensive student insurance plan that all students should have in place before they travel abroad to pursue their higher education. The coverage should have a stipulated coverage for Accident & Sickness Expense cover and some other mandatory benefit coverages in place. While currently most India students are opting for purchasing these policies from their respective Colleges/Universities, the Indian insurance companies also offer comprehensive insurance plans with benefits that match the College/University requirements (and sometimes exceed the same). Students are expected to have coverages for Accident & Sickness, Sponsor Protection, Cancer Screening, Maternity, Mental & Nervous Disorders, Personal Liability etc and most Indian insurance plans offer the same. The Indian insurance plans while being comparable on benefits are also extremely competitively priced with the premium being relatively lower than the premiums offered under the College/University plans. The Indian student health plans also offer cashless treatment for inpatient sickness and accident coverage.

What are some of the unique coverages under Student Guard program?Some of the unique coverages include:

Only Inpatient Medical expenses related to pregnancy, termination of pregnancy only as a result of physician’s advice to terminate pregnancy due to medical reasons and not due to insured person’s choice to terminate pregnancy subject to waiting period of 10 months

Medical expenses related to treatment for mental and nervous disorders, including alcoholism and drug dependency are covered subject to maximum amount as provided in the schedule of benefits

Medical expenses due to Pre-existing Condition in case of Life threatening unforeseen emergency subject to maximum amount as provided in the schedule of benefits. In such event, measures solely designed to relieve acute pain, provided to the Insured by the Physician for Disease/accident arising out of a pre-existing condition would be reimbursed. The treatment for these emergency measures would be paid till the insured becomes medically stable or is relieved from acute pain

Medical Expenses related to Cancer Screening and Mammographic examination on recommendation from a physician is covered subject to maximum amount as provided in the schedule of benefits. Any tests done as a part of preventive health check-up are not included under this benefit

For ongoing physiotherapy to treat a disablement due to an accident, unless this is recommended in writing by the treating registered medical practitioner, upto the amount as stated in the policy schedule

Childcare benefits – We will pay upto the maximum amount as provided in the schedule of benefits, if the child is in between the age of 7 days - 90 days, and is hospitalized for 2 days or more for any ailment.

Do international students need health insurance?Yes, off course all International students need to have a health insurance plan in place for two reasons : i) the University/Colleges insist on a mandatory insurance coverage during the duration of the study and ii) it is advisable that the student remains protected against any unexpected emergency and having an insurance cover becomes critical. But it is important for the student to have adequate protection not only from Medical emergencies like Accident & Sickness (A&S) but also Non Medical emergencies and this is where the Indian Student Health Insurance plans come in. Today apart from A&S coverage, the Indian Insurance plans also offer coverage for Loss of Passport, Baggage Delay/Loss, Sponsor Protection, Study Interruption, Maternity Coverage, Cover for Mental & Nervous Disorders, Compassionate Visit etc. These non-medical coverages are also relevant to a student venturing abroad for the first time for their studies. Hence it is strongly suggested that the Indian students/parents review the Indian Student Health insurance plans before making a final decision.